Why Seoul?

Domestic financial industry

Domestic Financial Environment

- Attractiveness of the Korean financial market

- Office space support

- Financial company licensing

- Employee recruitment and regulation

Seoul Financial Hub

- Who we are

- Seoul Financial Hub programs

- Apply for tenancy

- Tenant information

- Facility/visitation reservations

Alerts / News

Domestic Financial Environment

Financial company licensing

Overview

-

Banking

preliminary approval,

stage of approval -

Investment Advisory Business Entities

Registration process and

requirements -

Electronic Financial Business

Registration process and

requirements -

General private equity fund business

Registration process and

requirements

Foreign banks looking to open a branch in Korea need to follow different procedures according to the two types of branches they want to open.

You should go through different preliminary authorization and authorization procedures depending on whether you’re opening your first branch in the country or additional branches.

Foreign banks applying for establishing their first branch in Korea should obtain preliminary authorization and authorization.

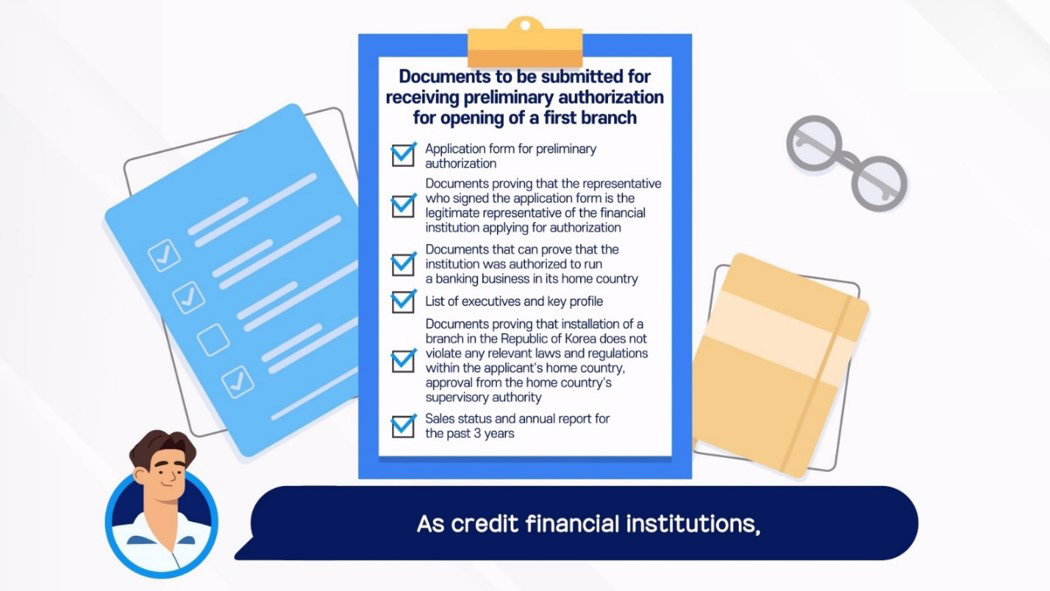

The documents required for obtaining preliminary authorization are as follows.

- ‧ Application form for preliminary authorization

- ‧ Documents proving that the representative who signed the application form is the legitimate representative of the financial institution applying for authorization

- ‧ Documents that can prove that the institution was authorized to run a banking business in its home country

- ‧ List of executives and key profile

- ‧ Documents proving that the installation of a branch in the Republic of Korea does not violate any relevant laws and regulations within the applicant’s home country, approval from the home country’s supervisory authority

- ‧ Sales status and annual report for the past 3 years

- ‧ BIS capital adequacy ratio and details for the past 3 years

- ‧ Branch operation plan and sales plan

- ‧ Status of the applicant’s handling of international affairs and status or plan for management of overseas branches already set up

- ‧ Business relations between the financial institution and the Republic of Korea

- ‧ Timeline

Here are some requirements that the headquarters of a foreign bank must meet.

- ‧ Legitimate consent for establishment from the home country’s supervisory authority

- ‧ Authorization to operate a banking business from the home country and be systematically supervised by the supervisory authority

- ‧ Sound financial status and business conditions to ensure the protection of bank users

- ‧ Capabilities for operating a domestic branch, and managing all branches located home and abroad systematically

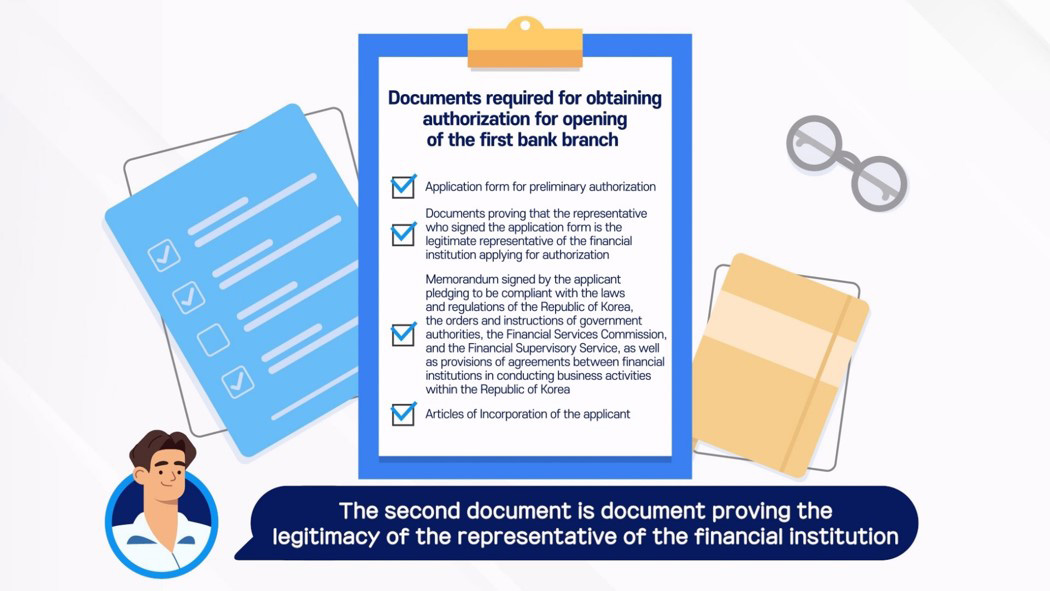

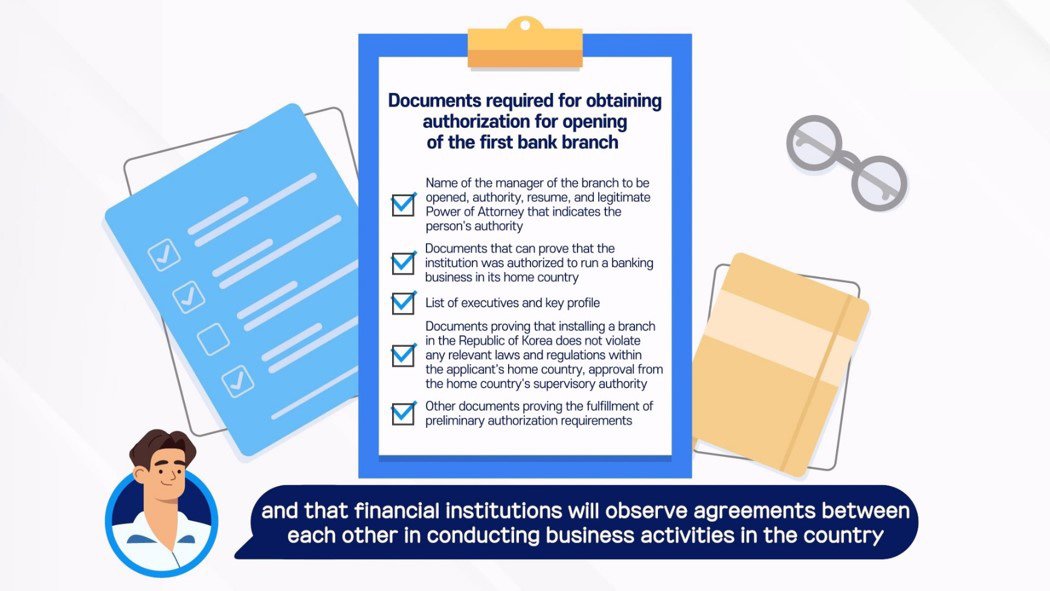

The documents required for obtaining authorization for opening the first bank branch are as follows.

- ‧ Application form for preliminary authorization

- ‧ Documents proving that the representative who signed the application form is the legitimate representative of the financial institution applying for authorization

- ‧ Memorandum signed by the applicant pledging to be compliant with the laws and regulations of the Republic of Korea, the orders and instructions of government authorities, the Financial Services Commission, and the Financial Supervisory Service, as well as provisions of agreements between financial institutions in conducting business activities within the Republic of Korea

- ‧ Articles of incorporation of the applicant name

- ‧ Name of the manager of the branch to be opened, authority, resume, and legitimate Power of Attorney that indicates the person’s authority

- ‧ Documents that can prove that the institution was authorized to run a banking business in its home country

- ‧ List of executives and key profile

- ‧ Documents proving that the installation of a branch in the Republic of Korea does not violate any relevant laws and regulations within the applicant’s home country, approval from the home country’s supervisory authority

- ‧ Other documents proving the fulfillment of preliminary authorization requirements

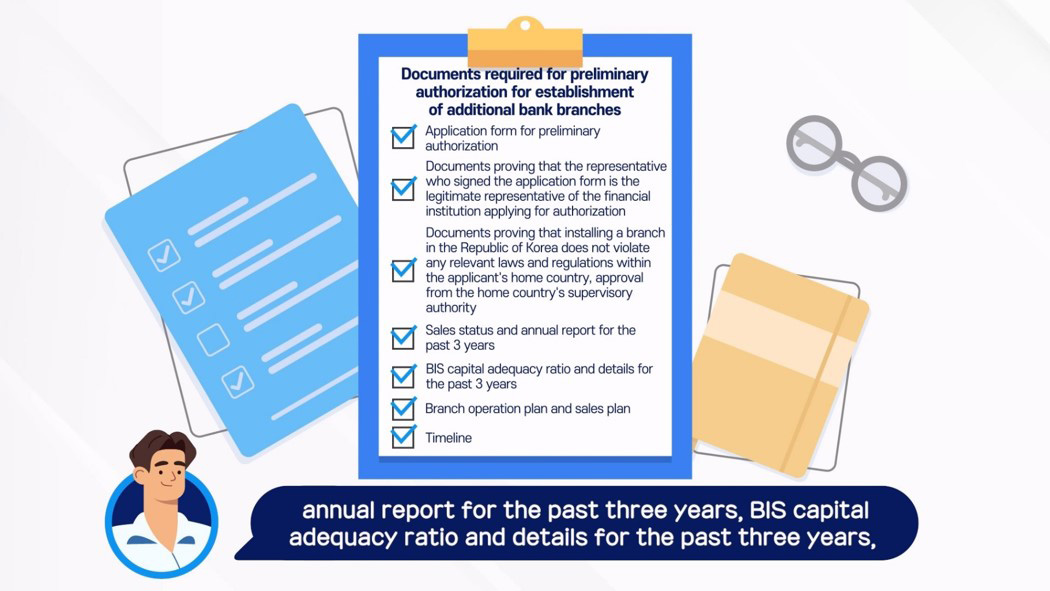

The documents required for preliminary authorization for the establishment of additional bank branches are as follows.

- ‧ Application form for preliminary authorization

- ‧ Documents proving that the representative who signed the application form is the legitimate representative of the financial institution applying for authorization

- ‧ Documents proving that the installation of a branch in the Republic of Korea does not violate any relevant laws and regulations within the applicant’s home country, approval from the home country’s supervisory authority

- ‧ Sales status and annual report for the past 3 years

- ‧ BIS capital adequacy ratio and details for the past 3 years

- ‧ Branch operation plan and sales plan

- ‧ Timeline

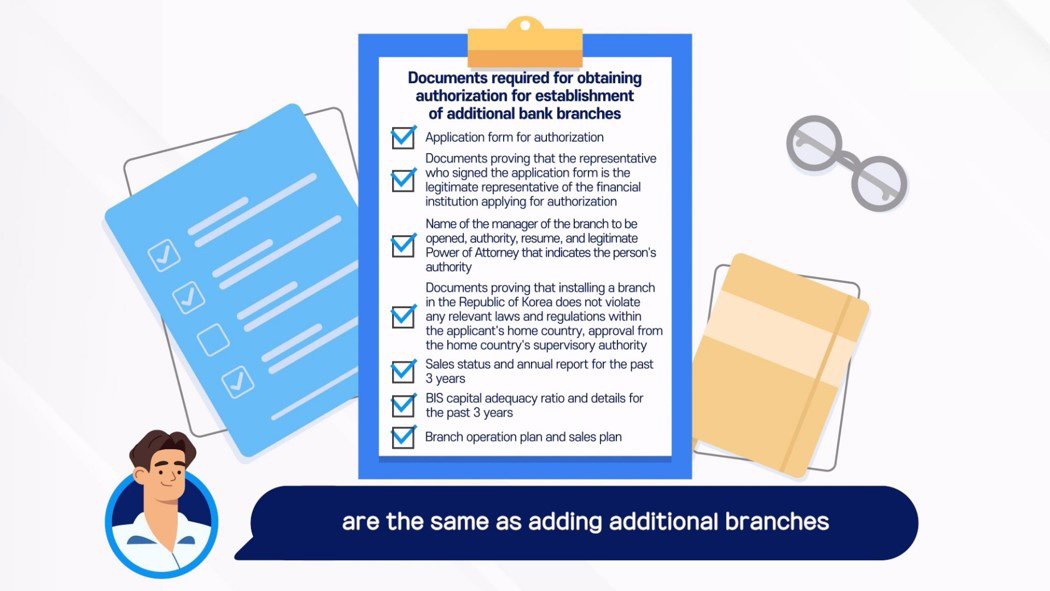

The documents required for preliminary authorization for the establishment of additional bank branches are as follows.

- ‧ Application form for authorization

- ‧ Documents proving that the representative who signed the application form is the legitimate representative of the financial institution applying for authorization

- ‧ Name of the manager of the branch to be opened, authority, resume, and legitimate Power of Attorney that indicates the person's authority

- ‧ Documents proving that installing a branch in the Republlic of Korea does not violate any relevant laws and regulations within the applicant's home country, approval from the home country's supervisory authority

- ‧ Sales status and annual report for the past 3 years

- ‧ BIS capital adequacy ratio and details for the past 3 years

- ‧ Branch operation plan and sales plan

For more information, please check the video below

What are some of the things that companies managing an investment advisory business overseas should consider when entering Korea?

Just like other overseas asset management companies, they should first register with the financial authority of Korea to establish an investment advisory business in the country.

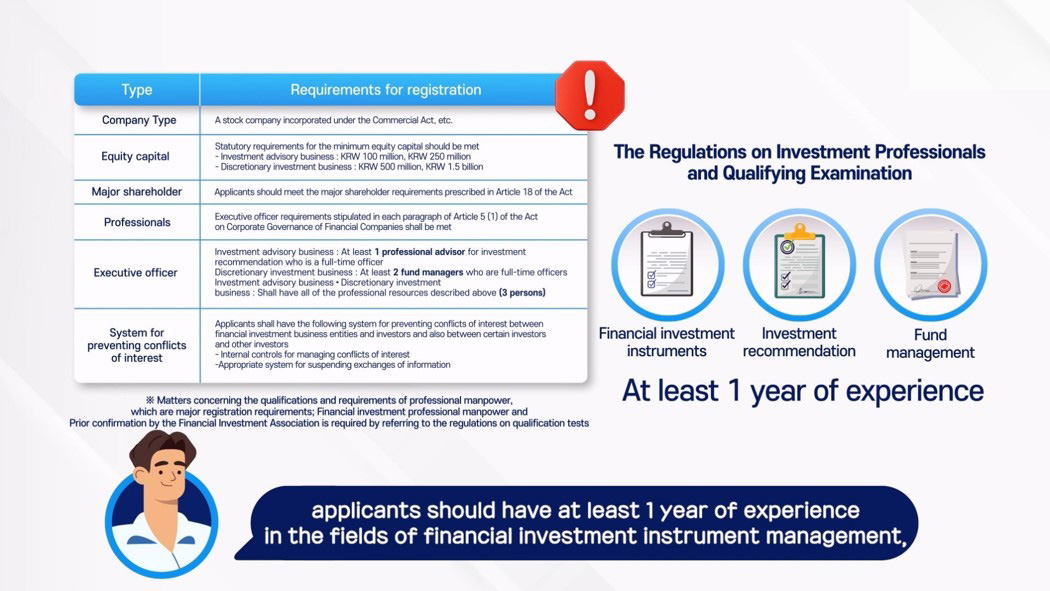

Investment advisory companies are categorized into investment advisory business entities and discretionary investment business entities according to the Financial Investment Services and Capital Markets Act.

Special caution is required because the requirements applicants vary according to the type of business and work performed.

Applicants should have an understanding of what investment advisory business and discretionary investment business are.

Advisory business refers to the business of providing advice on investment decisions in financial investment instruments.

Discretionary investment business refers to the business of acquiring and disposing of financial investment instruments with authorization from investors for discretionary judgment over the financial investment instruments.

The registration procedures are the same as overseas asset management companies.

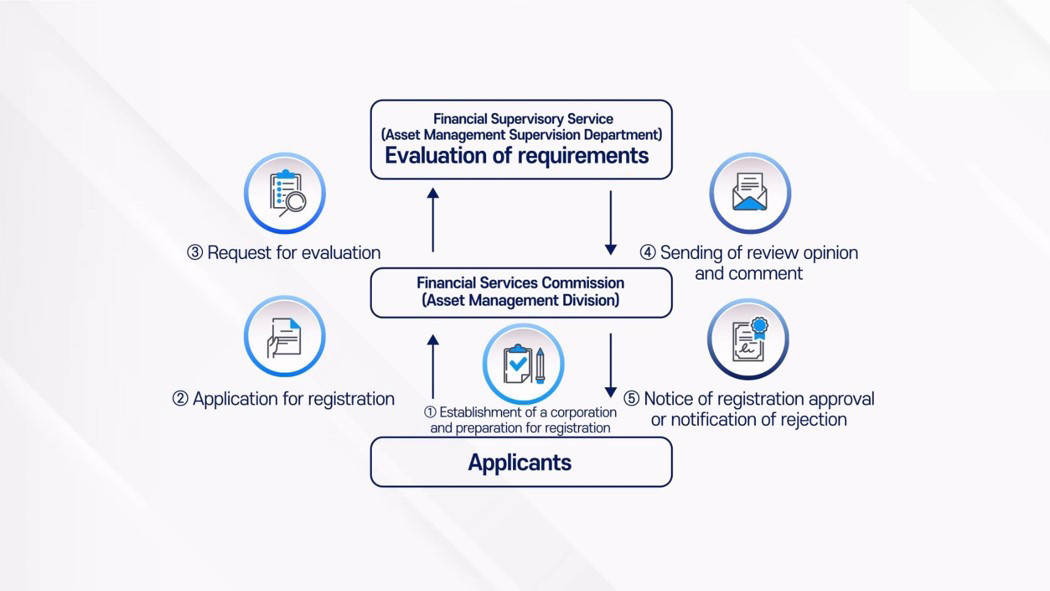

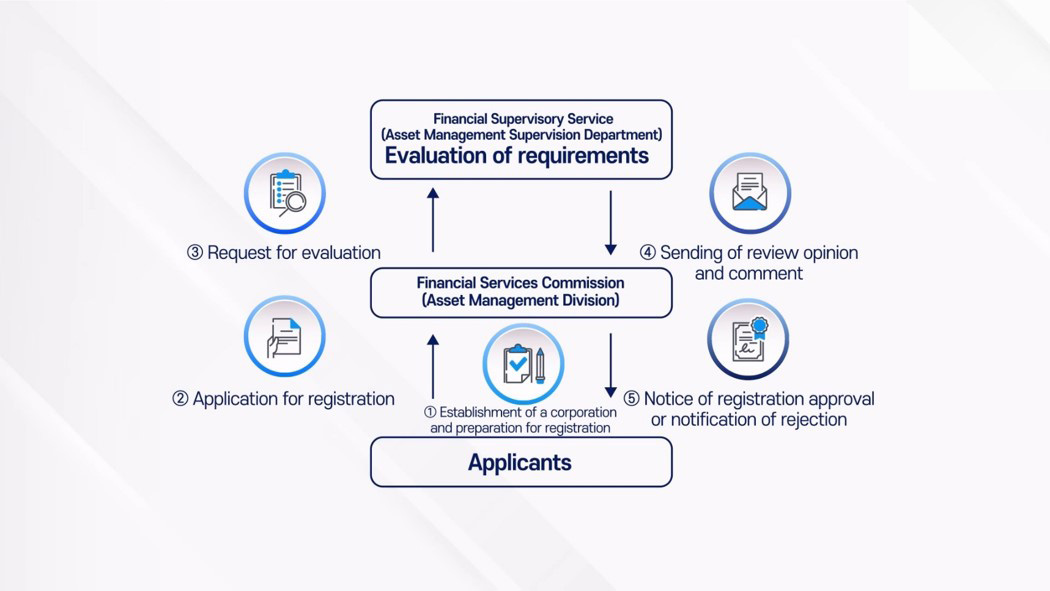

There are a total of 5 registration steps.

- ① Establishment of a corporation and preparation for registration Establish and register a corporation with the Financial Services Commission and confirm if it meets all legal requirements for registration.

- ② Application for registration [Company → FSC] Submit an original copy to the Asset Management Division of the FSC, and a copy to the team in charge of authorization/approval of asset management under the Asset Management Supervision Department of the FSS.

- ③ Request for evaluation [FSC → FSS] The FSC would request the Financial Supervisory Service to conduct examination on whether the applicant meets relevant requirements for registration.

- ④ Sending of review opinion and comment [FSS → FSC] Upon completing the examination, the FSS sends their comment and review opinion to the FSC, sometimes asking for the application to be updated or supplemented.

- ⑤ Notice of registration approval or notification of rejection [FSC → Company] The inspection is closed when there are no other comments from the Financial Supervisory Service.

There are a total of 6 requirements reviewed by the FSS

- ① Company Type

- ② Equity capital

- ③ Major Shareholder

- ④ Executive officers

- ⑤ Professionals

- ⑥ System for prevention of conflicts of interest

For more information, please check the video below

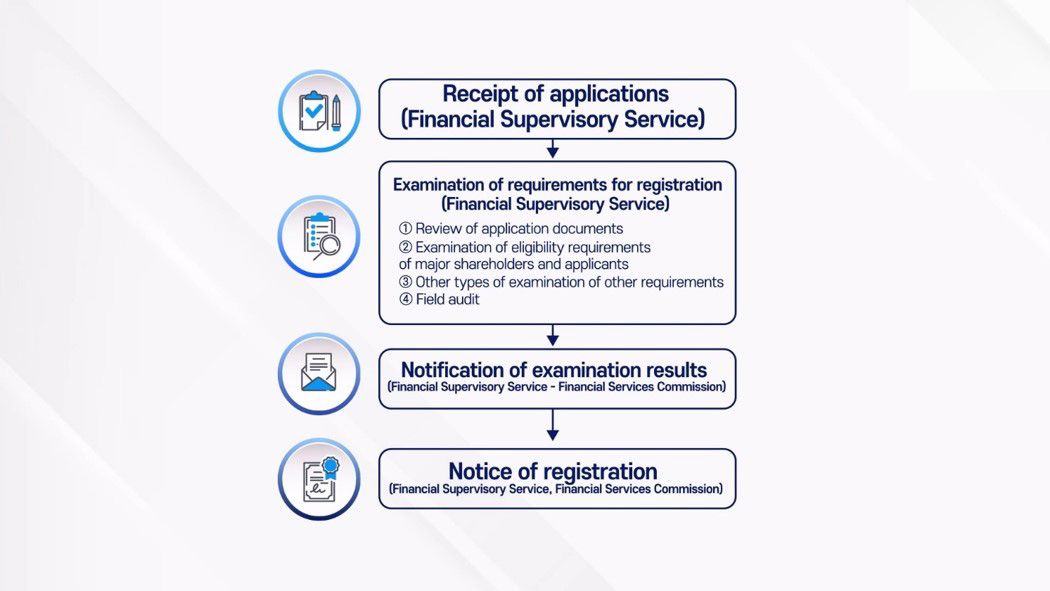

For a financial institution or a company to operate an electronic financial business in Korea, you should first apply for registration with the Financial Supervisory Service. After registration, applicants must go through an inspection on qualifications including capital and financial soundness.

Let's take a look at the seven requirements that FSS focuses on when examining the electronic financial industry.

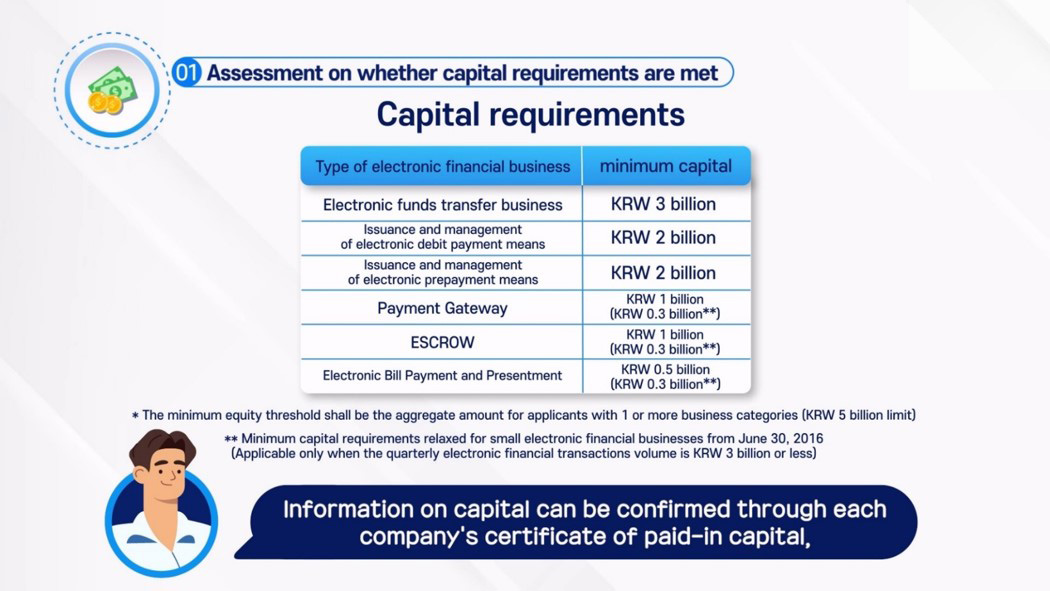

First, it’s important for applicants to meet capital requirements. Information on capital can be confirmed through each company's certificate of paid-in capital, and the minimum capital requirement is different for each type of electronic financial transaction company.

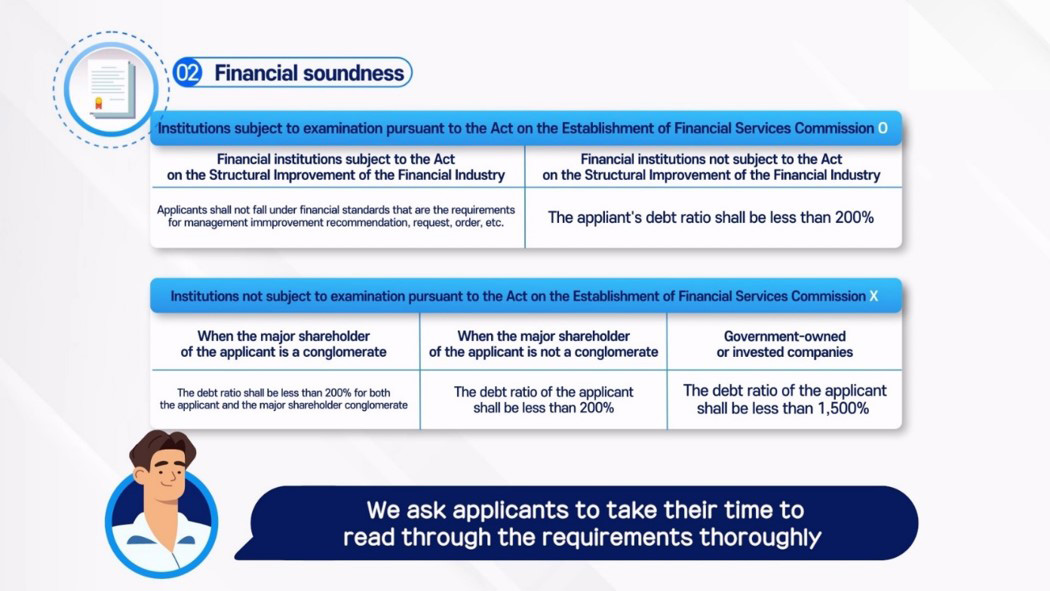

Next is financial soundness. The supporting documents applicants have to submit include evidence on financial soundness, including financial statements and income statements.

We ask applicants to take their time to read through the requirements thoroughly since the requirements for financial soundness would be different according to whether they're subject to examination or if 「The Act on the Structural Improvement of the Financial Industry」 is applicable.

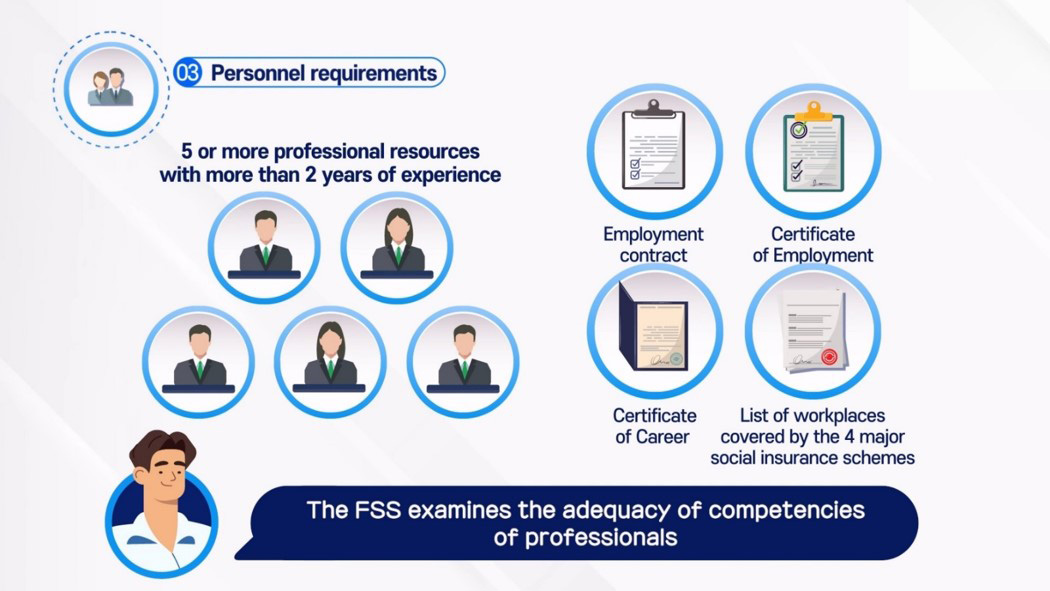

The FSS would also examine whether the applicant has professional manpower.

The applicant should have 5 or more professional resources with 2 or more years of experience at the time of application.

This is because professionals are capable of and responsible for the protection of users. The FSS examines the adequacy of competencies of professionals based on the supporting documents submitted.

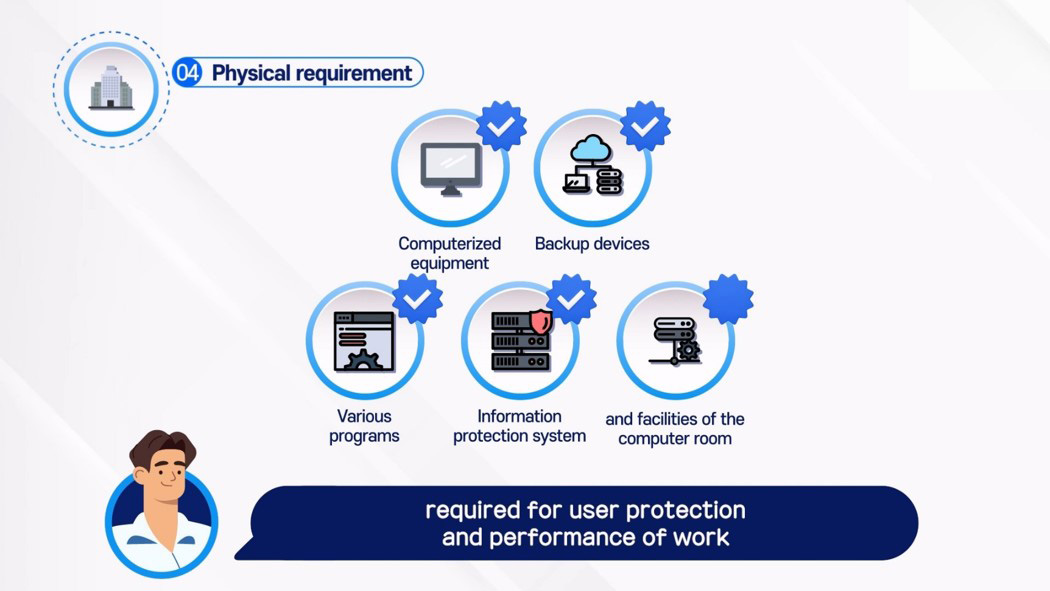

Whether the applicant possesses sufficient physical facilities for user protection and performance of work is also significant.

The Physical facilities include computerized equipment, backup devices, various programs, information protection system and facilities of the computer room.

For more information, please check the video below

If you're thinking of establishing a private equity investment business in Korea, your company would first have to become a licensed general private equity fund by obtaining approval from the Financial Services Commission and the Financial Supervisory Service in accordance with the Financial Investment Services and Capital Markets Act.

There are a total of 5 registration steps.

- ① Establishment of a corporation and preparation for registration Establish and register a corporation with the Financial Services Commission and confirm if it meets all legal requirements for registration.

- ② Application for registration [Company → FSC] Submit an original copy to the Asset Management Division of the FSC, and a copy to the team in charge of authorization/approval of asset management under the Asset Management Supervision Department of the FSS.

- ③ Request for evaluation [FSC → FSS] The FSC would request the Financial Supervisory Service to conduct examination on whether the applicant meets relevant requirements for registration.

- ④ Sending of review opinion and comment [FSS → FSC] Upon completing the examination, the FSS sends their comment and review opinion to the FSC, sometimes asking for the application to be updated or supplemented.

- ⑤ Notice of registration approval or notification of rejection [FSC → Company] The inspection is closed when there are no other comments from the Financial Supervisory Service.

There are a total of 7 requirements reviewed by the FSS

- ① Legal personality requirement

- ② Equity requirement

- ③ Manpower requirement

- ④ Physical requirement

- ⑤ Major shareholder requirement

- ⑥ Sound management and social credit requirement

- ⑦ Requirement for conflict of interest prevention

For more information, please check the video below

16~17F, IFC One Tower, 10, Gukjegeumyung-ro, Youngdeungpo-gu, Seoul, 07326, KOREA

TEL : 02-6346-2403E-mail : seoulifo@gmail.comCOPYRIGHT BY SFH. ALL RIGHTS RESERVED.