Seoul Financial Hub

Alerts / News

Announcements

|

2024 SFH Connect Financial Booklunch 6th (8/23) 관리자 │ 2024-10-14 |

|---|

|

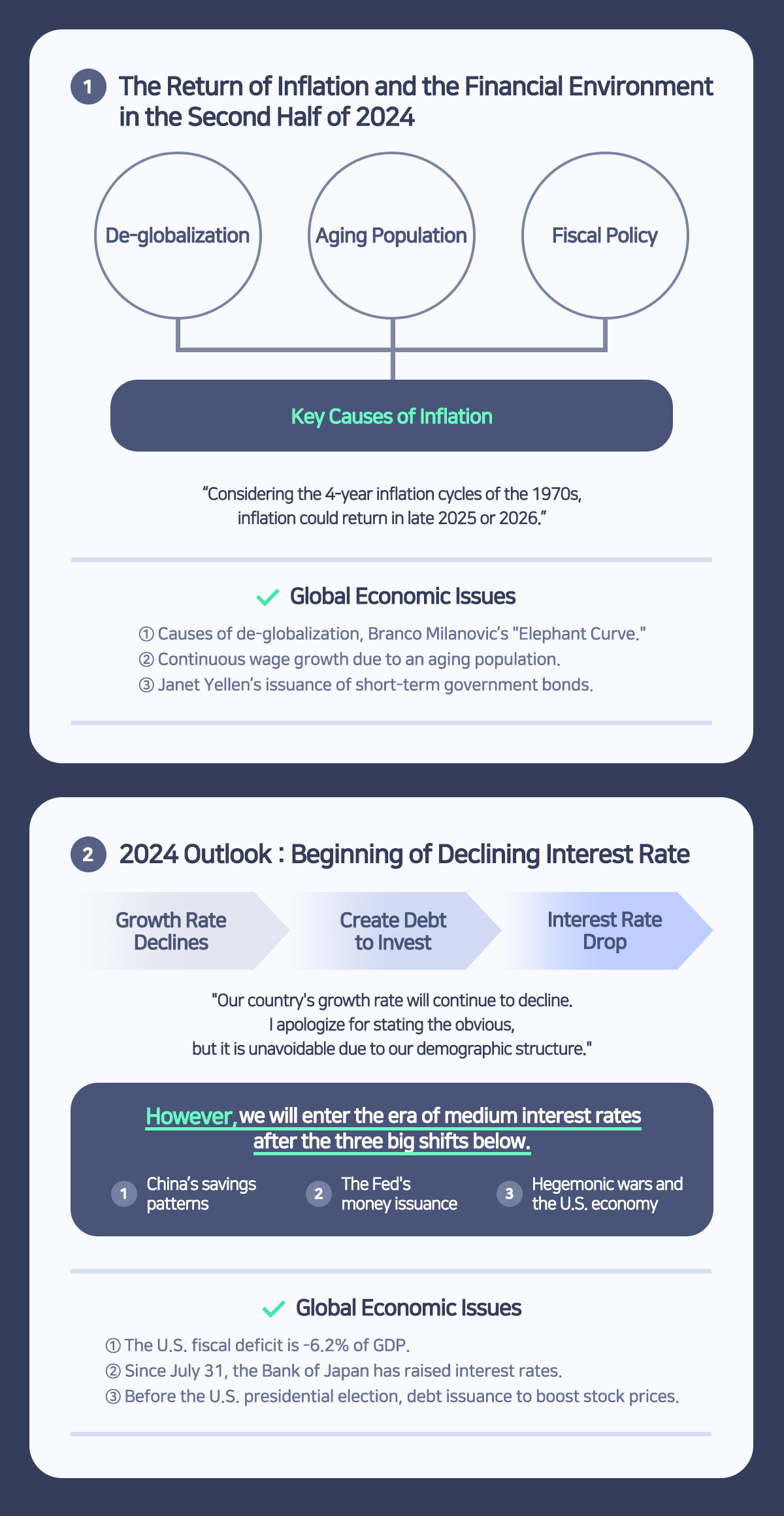

Hello, This is the Seoul Financial Hub. We would like to share the key points from the fourth Financial Booklunch that took place on August 23th. Please find the details below. [Giant Impact] by Journalist Jonghun Park** "Analysis of global economic issues such as Inflation, interest rate, exchange rate and high prices" -Date and Time: Friday, August 23th, 2024, 11:20 AM - 12:50 PM (1 hour 30 minutes) -Location: Seoul Financial Hub (16F, IFC One Tower, 10, Gukjegeumyung-ro, Youngdeungpo-gu, Seoul, Republic of Korea) Thank you.

|

| 이전글 | 2024 SFH Connect Financial Booklunch 6th (9/27) |

|---|---|

| 다음글 | Seoul Financial Hub, Seoul's incubator to develop global top-tier financial ce... |